[vc_row][vc_column][vc_column_text]

The accounts payable department in a business refers to the work where you pay your suppliers and, in turn, receive the products to put up in your store. Any pending payments, any discounts to be availed, and all the paperwork associated with your accounts belong to the AP department.

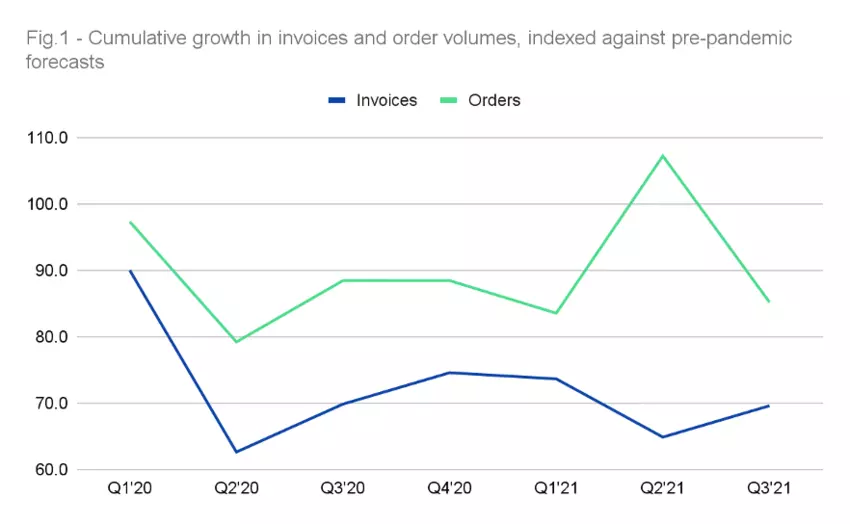

Source: https://www.weforum.org/agenda/2021/11/how-to-stop-supply-chain-issues-disrupting-the-economic-recovery/

While the supply chain involves a lot more than the scope of this article, any disruption in the supply of products or the selling of these products will lead to a disruption in the accounts department of your business. This article will highlight how the ongoing supply chain crisis affects your AP department.

Delay in payment

With the advent of the pandemic, every industry has seen a huge shift in the supply and demand of products. The clearest of them all is in the sanitation industry. While people used to buy sanitary products like masks and sanitizers before the pandemic too, after the virus took effect the demand increased explosively, causing there to be excess demand and inadequate supply. Due to this break in the supply chain in various such sectors, many big companies have started delaying their payment to their suppliers.

These delays in payments are nowadays extended to over 90-120 days, which is a very long time to go without any payment. Such actions affect the trust between you and the supplier and also adversely affect your AP department. Backlogs in such payments can increase the workload and the paper load in the accounts department.

Additional Financial Costs

When there is a shortage of a certain product, like we have seen a lot during the first wave of the infamous CoVID-19 pandemic, it is often followed by inflation. This isn’t just at the retailer to the consumer level but also at the distributor to supplier level. This means that if you want quick and immediate services, you often will have to pay a lot extra. These financial costs are not just damaging your business, but your accounts department too.

If you have automated your AP workflow, there are certain values you might have entered for the cost of certain products. You’ll have to overwrite all the costs that you have fed in, which is a huge hassle. It is even harder if you are doing the work manually, you’ll have to account for every last penny that is being spent in the company.

Subpar product quality

As demand increases, production will also increase. However, keep in mind that all the processes are facing an increasing shortage of raw material or the supply of the same. Due to this, the product quality is affected gravely. Any form of marketing or branding falls short of making the product successful if you don’t have the quality to back it up. The products that are being made after the pandemic have defects, which disappoint the retailers, which ultimately adds up to the supply chain.

Any form of defect in the product means that it will be returned or scrapped, both of which incur losses in the ledger of the company. This ledger is then overlooked by the accounts payable department, which has to look at all the payments that have to be made to the vendors and suppliers. This is also a matter of goodwill between you and the vendor.

Difficulty in accessing capital

Many small businesses find it difficult to access their capital in the middle of such a supply chain crisis. They find it difficult to pay basic bills like electricity or water bills and to top it all off there is a shortage of products. This causes the capital to diminish at a faster pace causing the business to see many ups and downs. This supply chain crisis has been affecting everyone adversely, especially the businesses that had been steadily growing before the lockdown.

The accounts payable departments of these businesses have been growing too, considering that they haven’t been dealing with big amounts of money. This means that due to the excessive workload these businesses are facing, they have been suppressed and haven’t been growing well. Capital has been a problem for many startups, due to which many people have been facing a great deal of stress.

Endangering goodwill

The goodwill between the business and the supplier is a very pristine relationship that should not be broken in any situation. However, this supply chain crisis puts this goodwill between a rock and a hard place. Suppliers find it hard to supply the product to the retailers on time, while the business people find it hard to pay off the money on time. Due to this, the accounts payable department also faces many mishaps; the entire money is put on hold, the paperwork increases, and the workload gets stressful. This also adversely affects the AP workflow.[/vc_column_text][/vc_column][/vc_row]